Accounting for Segment Reporting IFRS versus GAAP

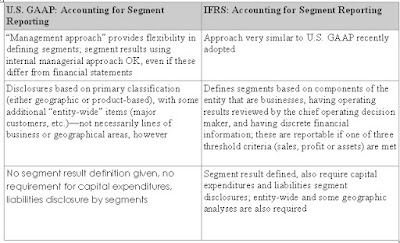

Listed below are some of the major differences between International Financial Reporting Standards (IFRS) and U.S. GAAP in accounting for segment reporting. This material is excerpted from Wiley IFRS 2010: Interpretation and Application of International Financial Reporting Standards.

Contact IFRS international accounting expert Dr. Barry Epstein, CPA for more information. Learn more about Dr. Epstein at www.ifrsaccountant.com. He can be reached at bepstein@rnco.com or 312-464-3520.

SUmber: http://www.ifrsaccounting.com/ifrs-segment-reporting.html

Segment reporting is the practice of breaking down accounts in an annual report to detail activity in particulars section of a business. In many countries, accounting rules mean this must be done where a business can clearly identify sections of a certain size. The idea is to give investors a better insight into the way a company is being run and any potential problem areas.

Most countries which have such rules do so under International Financial Reporting Standards. These are rules and principles agreed by international bodies with the aim of making it easier to compare the performance of companies in different countries. The rules on segment reporting appear in IFRS statement number 8, first issued in 2006 and updated at several points since. In the United States, these rules build upon and replace previous domestic rules known as Statement of Financial Accounting Standards number 131.

Under IFRS 8, there are three situations in which a business segment must be detailed in accounts. The first is if it makes up 10% of more of the company's total revenue. The second is if its operating profit makes up 10% or more of the company's total operating profit; this does not include general company expenses which can't be accurately allocated to a particular area of the business. The third situation is if the segment's assets make up 10% or more of the business' total assets.

There are some limitations on these segment reporting requirements. One is that a company should generally only detail up to 10 different segments in its annual report, even in the rare situation where more than 10 segments meet the qualifying limits. In this situation, the 10 largest segments overall should be listed.

Another rule is that all the segments which are listed should combine to make up at least 75% of a company's total revenue. If this isn't the case, more segments must be detailed, even if they wouldn't normally qualify. Segment reporting isn't needed if a company gets at least 90% of its revenue from a single area of business which can't be divided. There is also a rule that once a segment is detailed, it should usually continue to be detailed in future years, even if it has dropped below the qualifying criteria.

For each segment which is detailed, a company should list all the major relevant factors. These can include government contracts, overseas business and major clients. The report should give enough detail that the segment's strengths and weaknesses can be assessed by investors.

Sumber: http://www.wisegeek.com/what-is-segment-reporting.htm

0 Celoteh

Post a Comment

Hello.. Thank you for commenting.. ( ◕◡◕)ノ ✿

your comments is my spirit and really made my day (ღ˘⌣˘ღ) ♫・*:.。. .。.:*・

__Berkomentar dengan url ( mati / hidup ) tidak akan di publish__